The party is over.

After 2+ years of bidding wars, buying sight unseen, and prices rising three times faster than normal, housing market conditions are slowing down. This should be treated as a welcome reprieve, a chance for buyers, sellers, realtors, lenders, and everyone who watches the housing market to catch their breath and reset. Overall, expect housing market activity to continue to slow through the second half of 2022 and into early 2023, with adjustments to sales and price growth putting market conditions more in line with pre-COVID trends.

Several economic headwinds are working to decelerate the housing market, most notably higher mortgage rates, high inflation, and general economic uncertainty. However, underlying demographic and economic fundamentals suggest no major housing market downturn. Instead, during the second half of 2022 and 2023, the housing market will return to a more typical level of home sales activity, with seasonality re-introduced to the market.

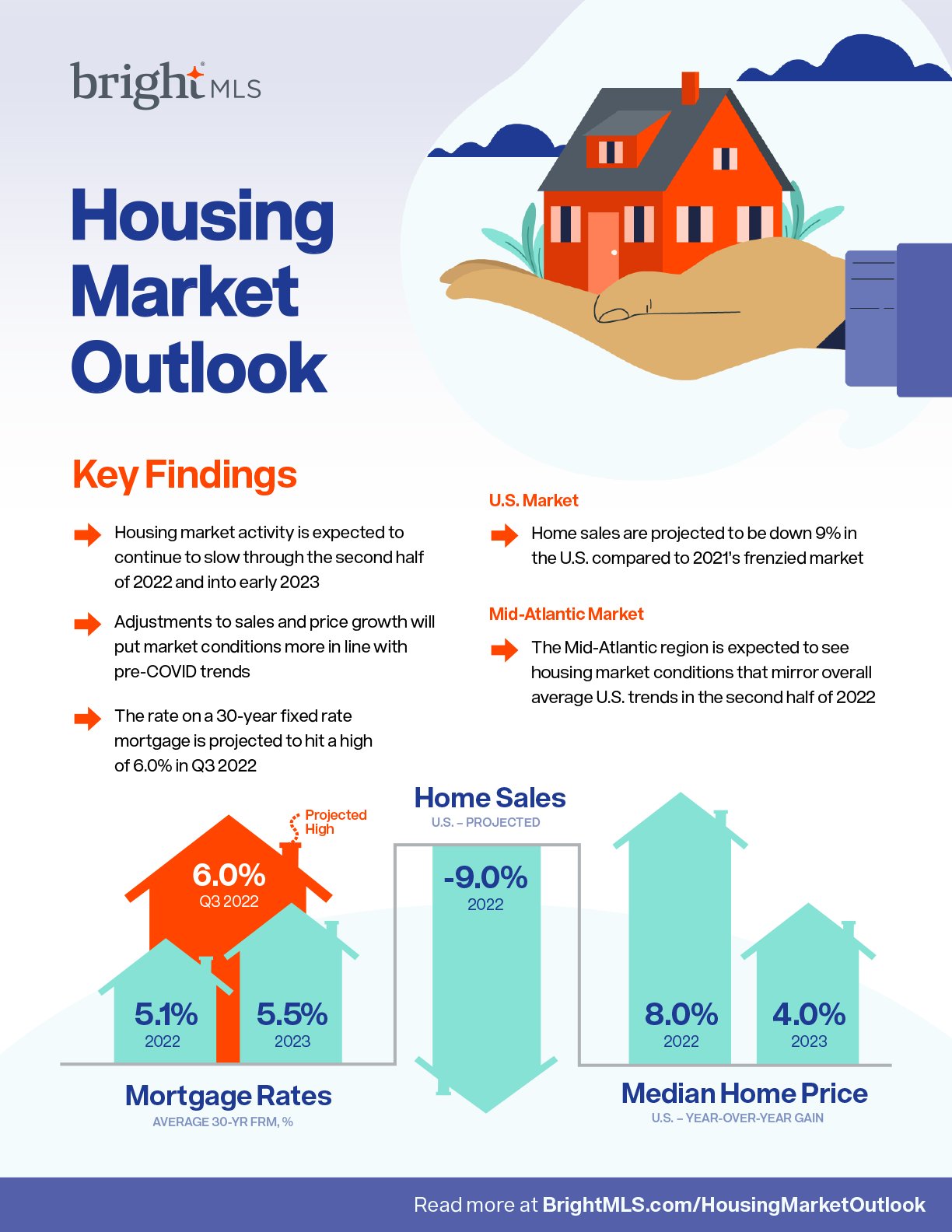

Low mortgage rates had been a huge driver of housing demand during the pandemic. But rates have risen at a historically fast rate in the first half of 2022. For the rest of the year, rates likely will bump around, trending slightly upward. The push and pull on mortgage rates results from Federal Reserve rate hikes along with global economic uncertainty and reduced mortgage demand. The rate on a 30-year fixed rate mortgage is projected to hit a high of 6.0% in Q3 2022, but will end the year at 5.5% with mortgage rates continuing to hover in the mid- to high-five’s through 2023.

Overall, expect housing market activity to continue to slow through the second half of 2022 and into early 2023, with adjustments to sales and price. In some localized markets, there could be year-over-year price declines, but very low inventory and strong demographically-driven demand suggest no widespread price drops. Supply will expand some, but inventory will continue to be constrained in the second half of 2022 and 2023 as a result of “rate lock” where existing homeowners have locked into 30-year mortgages at sub-three percent rates and are disincentivized to move to take on a mortgage with a higher rate.

Thanks to Dr. Lisa Sturtevant at Bright MLS for this insightful information! As always Wolfe and Company Realtors is here to help you through the process of buying or selling your home, no matter the economy. Please reach out with any questions you may have!